Find the Best Canadian Insurance Providers for Your Needs

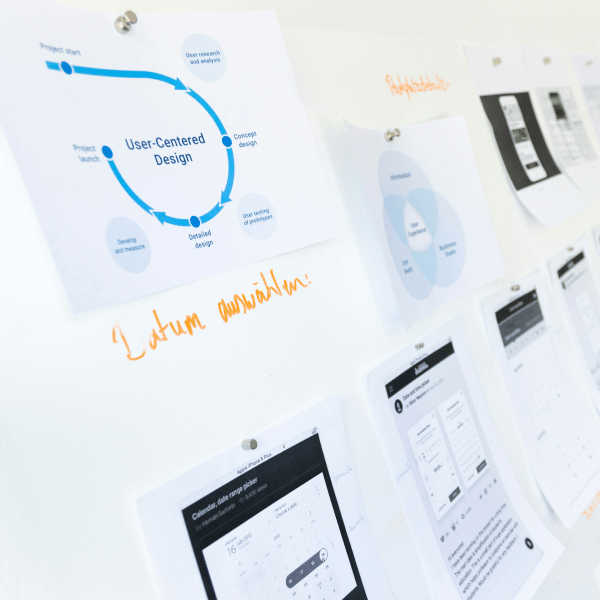

Check out the latest updated list of top Canadian insurance providers below at The Best Canadian Insurance..

Auto Insurance

Compare top-rated car insurance companies for coverage that fits your driving habits and budget.

Home Insurance

Protect your property with trusted home insurance providers offering comprehensive plans..

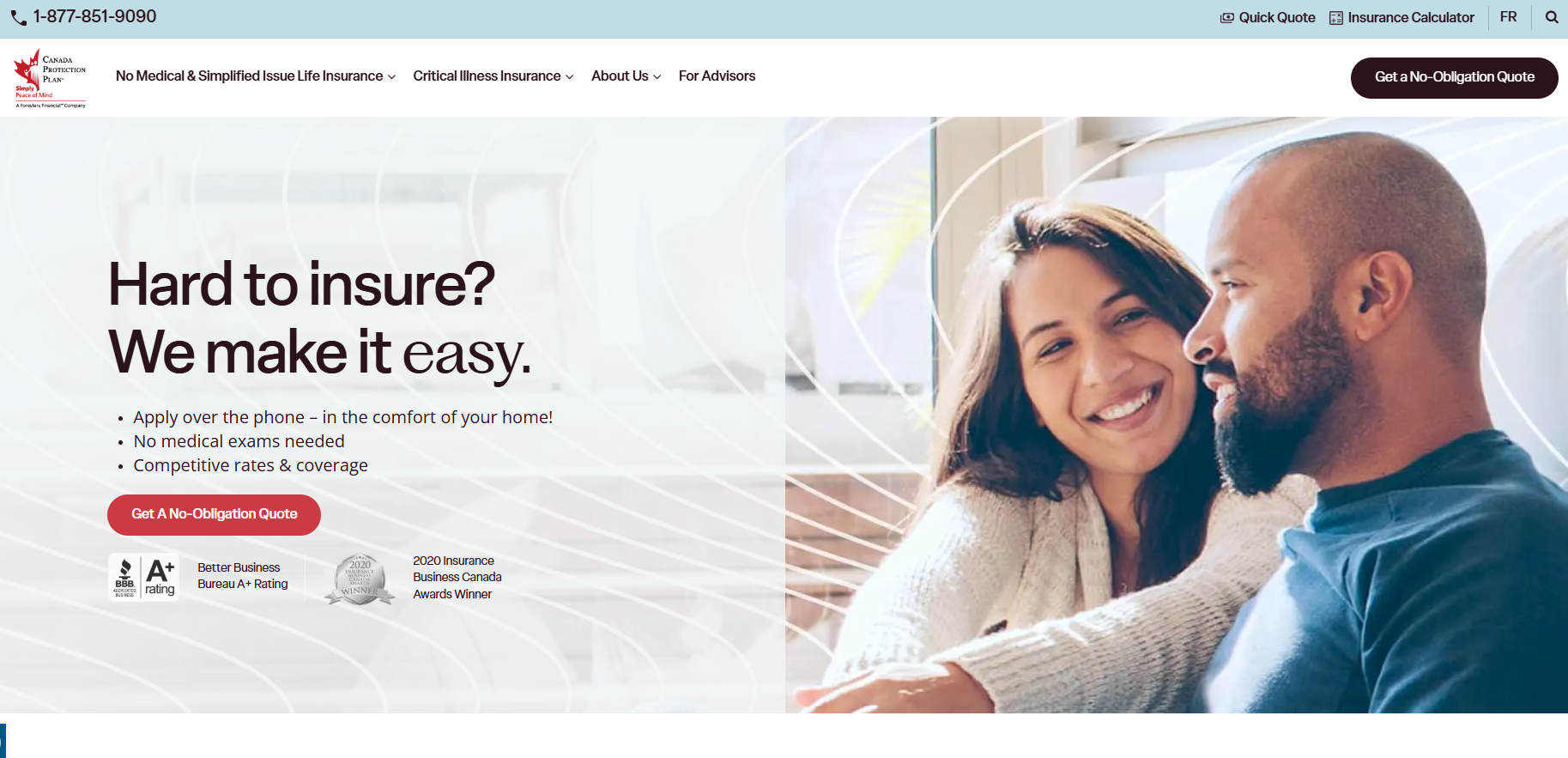

Life Insurance

Discover reliable life insurance companies to safeguard your family’s future.

Health/Travel Insurance

Interdum dolor sit amet elit do sed eiusmod tempor.Explore the best providers for personal health coverage and travel protection across Canada.